The historian, Arnold Toynbee, noted that the Universal State, the empire which politically unifies all the contending nations in the final phase of a civilisation, may bring peace and stability but it also produces monstrosities. We are familiar with some of the monstrosities the Roman Empire produced in the form of the mad Caesars Nero, Caligula, Commodus and Maximinus Thrax. Other monstrosities from Rome included the incredibly cruel and brutal punishments handed out to political opponents. Falling on your own sword was certainly a wise move if you happened to be a nobleman watching a contingent of soldiers coming to steal the gold from your estate.

We all live under the Universal State of the Faustian civilisation which is being run out of Washington D.C. and so it’s not that much of a surprise to see the arrival of various monstrosities in our time. The GFC and the corona debacle have to rate right up there with the best of the bunch. The current enormous influx of illegal immigrants into the US is perhaps the latest example in terms of the sheer scale of the operation and also the baffling politics of the matter. The polls that I’ve seen indicate that there is large majority support from the voters of both major parties to put an end to it and you would think that a democracy could at least pretend to care about the wishes of the voters. Instead, the two main parties are apparently stitching up a bill that would essentially legalise the whole business.

In order to understand what’s going on you have to first understand that the US is running an empire but it’s a very unusual kind of empire. Some historians have called it an Informal Empire. Other phrases that work would be an Occult Empire, an Esoteric Empire or an Unconscious Empire. I’ve preferred to use the latter term since another baffling aspect of the whole business is that a majority of Americans are not even aware that their government is running an empire even while the government blatantly pursues the interests of the empire over the will of the people. That is, of course, exactly what is behind the border shenanigans. It’s about the interests of the empire.

None of what is happening now is an accident. In fact, the economist, John Maynard Keynes, pretty much predicted the current situation back in the years immediately after WW2 when the terms of US empire were being worked out. The US empire is built on the back of the US dollar’s reserve currency status. What many people don’t realise is that the nature of the system is very unusual, even unprecedented. That’s why even the technocrats at the Federal Reserve admit that we are currently in a big experiment.

Prior to the current fiat currency experiment, trade was conducted in either gold or silver or paper that was tied back to gold or silver. Most people will have heard of the Opium Wars. The Opium Wars were partly triggered by the fact that the British East India Company was struggling to gets its hands on enough bullion to buy tea from China. Since the Company had access to the enormous poppy fields of the subcontinent and surrounding area, opium was one way to facilitate trade with China. The underlying problem, however, was lack of gold with which to transact.

The advent of paper currencies tied to gold did much to alleviate this problem. In the 19th century, the British Pound was probably the main currency for trade but there were plenty of other currencies in circulation and most countries would have traded in many different currencies. For the most part, trade continued to grow and it did benefit the nations who engaged in it. The reason is because the currency earned from trade could be used domestically for investment and consumption. Australia is a good example. We were “built on the sheep’s back”. We traded wool and used the money to invest domestically.

The other nice thing about that system was that it was self-correcting. If the convertibility of a currency into gold was called into question, for example if there were too many Pounds circulating relative gold holdings, traders moved away from that currency and drove down demand. Moreover, the Bank of England and other banks had to ensure confidence in the currency was maintained which they did by adjusting interest rates to bring things back to balance.

It was the absence of this balancing that Keynes saw as the problem with the agreements made at Bretton Woods and which would become even more pronounced with the closing of the gold window in 1971.

Let’s take an example. Australia sells wool to Britain in the 19th century. Somebody makes a profit. What are they going to do with it? Chances are, they will either spend or invest it locally since foreign investment is difficult and comes with its own costs. The profits from trade benefitted the nation.

Let’s take a similar situation today but in a developing country. You sell something to the international market and you make a profit. What are you going to do with the money? You could invest it in your own country. But, now, there are a variety of financial instruments available to you in the US and other western nations that will give you a guaranteed return. So, you’ll take those guaranteed returns over the more risky investment in your own country. What this means is that the profits from trade are no longer invested locally but go off overseas looking for a better and lower risk return.

This leads to the situation that Keynes predicted where there are now permanent imbalances in the system. The US deficit of $34 trillion dollars is the surest evidence for that. In addition, there are nations who have based their economy on permanent trade surpluses. Japan and Germany are two prime examples. Brazil and China have jumped on board in the last couple of decades.

There are a number of side effects of this imbalanced system. Firstly, domestic demand in the nations that run surpluses is permanently curtailed. I have some personal experience of this since about five years ago I was offered a job in Germany. They asked me for my salary expectations and I told them what I was currently earning here in Australia. It was about 1/3rd more than the equivalent job in Germany. Now, the absolute cost of living in Germany is lower and so it may be that my standard of living in Germany would have been similar to what I have in Australia. But, in absolute terms, I would have taken a pay cut. That’s the problem for Germans, Japanese and especially for Chinese.

The problem for Americans and other western countries is that by allowing other nations to run trade surpluses they put their own manufacturers out of business and that means the loss of working class jobs, something which has now become a major political issue. Perhaps more important is the fact that the system massively increases the power of bankers and billionaires vis a vis the rest of society. Those bankers and billionaires then buy off the political class thereby permanently tilting the table in their favour. This also explains all the various nonsensical and fake “social movements” of the past decade or more. They are all funded by monied interests to distract the attention of the public. (In fairness, some of it is just the fever dreams of billionaires with too much time and money on their hands).

There’s another side effect, though, and this brings us back to the border crisis. Why are there so many people from all around the world clamouring to get into the United States and Europe? The answer is yet again related to the systemic imbalances that the post-war system creates. We are told that developing nations have corruption problems and that is certainly true. But a big part of that corruption stems from the fact that the elites in those nations are incentivised to take their capital and invest it not in their own country but in the financial instruments provided by the United States and other western nations.

Thus, developing nations not only suffer the demand suppression, they also no longer invest in productive enterprises at home. The money gets sucked out of the local economy creating the exact conditions in which corruption takes over as locals are left to try and screw whatever they can get out of the system. Then, the investment money which does flow comes not from locals but from overseas banks serving their own interests and not those of the local population.

Meanwhile, the elites from those countries jet off on overseas holidays, keep permanent apartments in the fashionable districts of western cities, send their kids to Harvard and Yale and generally live it up at the expense of their countrymen.

This is all related to a larger problem in the post war years where the West actively supported various dictators in the Middle East and other countries. The reason? It’s easier to do business with a dictator who will do all the dirty work to keep his own population in line. China has taken that dynamic to a whole new level with the social credit scores and other dystopian measures that are designed to keep Chinese citizens from getting any ideas about wielding economic or political power.

The result of all of this is to create an enormous number of people who see no hope living in their country and will take any chance to flee it. Apparently, there are quite a large number of Chinese among the illegal immigrants crossing the US border these days. Perhaps they are spies for the CCP. Perhaps they just want to get the hell out of China.

In the meantime, the US has also created cultural conditions internally where to do any job other than a professional office job is somehow to be seen as a failure. Alongside the gutting of the manufacturing sector, this leads to huge numbers of people dissociating from society in drug addiction, porn, computer games and all the rest. These are the people who could be doing important manual labour jobs like harvesting vegetables, working in abattoirs and all the other things that actually put food on the table. Instead, those workers need to be imported which is exactly what is behind the push to give all these illegal immigrants work visas.

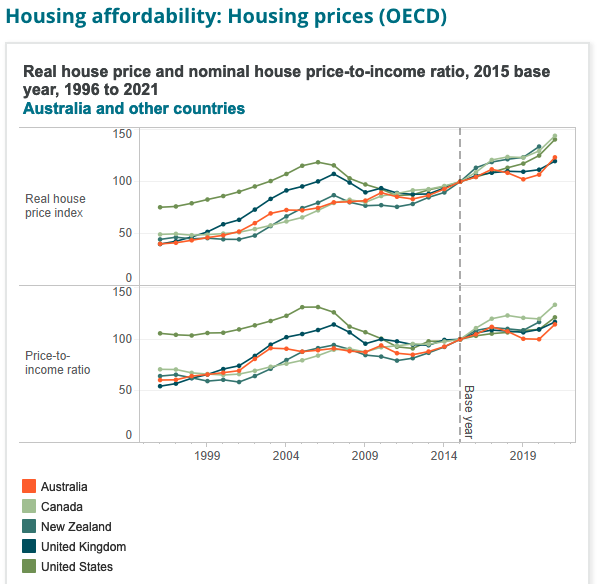

There is one final side effect worth pointing out. The whole system relies on western financial markets being completely open, transparent and reliable. Foreigners are actually buying real assets in western nations, thing like real estate, agriculture, stocks, bonds etc. That is why we are now seeing massive asset bubbles. Even the US is now catching up to Canada and Australia for what is another monstrosity in the making; probably history’s greatest real estate bubble.

The reason why all this has been getting so much worse in recent decades is because the neoliberal agenda of the 80s and 90s pushed the whole dynamic into overdrive. In fairness, it seems the US discovered how far it could push things more by accident than design (although it is possible there were some smart cookies behind the scenes who knew exactly what they were doing). Thus, China has entered the system on a very similar footing to Germany and Japan. The allowance of China into the international system has been like pouring fuel on the fire. To make it work, western nations dismantled their manufacturing sectors and privatised everything that wasn’t nailed down to increase the amount of assets available to soak up foreign capital.

As for real estate, well, see for yourself.

Keynes was right. We now have permanent, asymmetric growth and permanent asymmetric growth is almost the literal definition of the word monstrosity.

But, of course, all of this is a feature and not a bug. Even if the methods have been discovered by accident, all the decisions made have been in the same direction and with the same goal in mind: to maximise the power that the United States and its proxies wield through control of the financial system.

Increasingly, that power is now being turned against the citizens of western nations. I’m sure there must be some iron rule of politics that how you run your foreign policy eventually becomes how you run your domestic politics. The elites of the western nations have become just like the elites of the foreign countries who they have championed: happy to throw their own citizens under the bus to perpetuate their own power.

How much longer any of this can go on for is anybody’s guess. The monstrosities seem to be multiplying exponentially and they are lining up one after the other like an old-fashioned freakshow. Which is why our society increasingly resembles a circus.

Simon: “In fairness, it seems the US discovered how far it could push things more by accident than design”

A lot of the stuff that we see is probably accidental, and the whole edifice may end up collapsing by accident. Take the brilliant idea of confiscating the assets of Russian robber barons (much to the cheering of a great many ordinary Russians). So, how much longer will the international robber barons continue to park their assents in places like London and New York?

Irena – I think it’s a similar mechanism to natural selection. Yes, the exact methods may arise “accidentally” but the “filter” is not accidental and the filter always selects for what brings the most benefit (power) to whoever controls the it.

Yes, the Russian robber barons will need to find somewhere else. Where are they gonna go? China? Where the party can steal your money at any time (and not just on geopolitical grounds).

The Russian robber barons may have to leave some of their assets in Russia! Horror of horrors (hehehe).

Maybe they can start a Russian superyacht industry 🙂

Interesting that you cite Toynbee. I have a copy of his “Civilizations on Trial” right in front of me, on my desk. I am rereading it, planning to post some comments on it one of these days.

Ugo – I haven’t read that one, although I’ve re-read his Study of History twice in the last year as research for my upcoming book. I seem to recall that Toynbee predicted that something like a United Nations would become the Universal State. I wonder if he ever realised the extent to which finance would become a covert form of empire.

Hi Simon,

Thank you for the clear explanation of the system as it stands. It is worthy noting that in the between war years, the UK treasurer at the time, Sir Churchill (possibly not knighted in those days) attempted to re-link the pound to the gold standard. Hmm.

However, the present systemic risk is that other international players caught within the system will take actions to disrupt the system, and also subvert the system.

You can see this going on with err, attacks on trade vessels in certain parts of the world. Also alternatives are being put in place such as the Chinese alternative to the SWIFT settlement system. With each loss, no matter how minor, the costs for the existing arrangements build. Sooner or later, there is a tipping point where costs exceed benefits, it’ll wobble on for a bit afterwards, then who knows what might happen? I genuinely have no idea how things will play out.

Hey, there is an absurdist element to monstrosity. $34tn carries a lot of weight, and the future projected debt servicing graphs at current growth rates truly look absurd to me. Better than anything Monty Python ever came up with, maybe!

There is a really sad desperation inherent in the attempts to maintain the present circumstances. Such as say, the artificial support for housing demand relative to supply. I was listening to a youth news radio program earlier this evening, and truly, the prospect of renting has been likened to the ‘hunger games’. And I believe the comparison to be apt.

Crazy days.

Cheers

Chris

Chris – the history of currency and finance is worth reading as it’s basically one long series of monumental cock-ups and accidental breakthroughs. For example, Britain originally got onto a gold standard because none other than Isaac Newton was in charge of the Royal Mint and screwed up the calculations in such a way that silver got taken out of circulation. Meanwhile, the French were one of the earliest to try paper currency backed by silver. It crashed and burned and much of the French aristocracy went either bankrupt or very near bankrupt.

At this point, it might actually be a good thing if the BRICS countries manage to launch an alternative to the current system. I’m not holding my breath, though. One thing all those countries have in common is rampant corruption. The US system doesn’t have to be good, it only has to be better than the competition.

It occures to me this current state of affairs arises because we live in a society where interpersonal interactions were replaced by abstractions.

David Graber wrote in his book about debt about how a trade balance is essentially a debt one country owes to another for getting things sent to it. In times when strong central states did not exist, actual traders needed to stake their reputation and lives going on perilus journeys, forging personal relationships with manufacturers and intermediaries. This became redundent as states could either abstract this relationship away using notions of numbers such as trade deficits, or force the transfer of goods via gunpoint (David Graber makes a case the trade of oil exclusively by the dollar is an example of both).

A similar situations happen with the people in the third world who invest in the western financial sector at the expanse of their own country – when you can rely on financial abstractions to live comftubly, you do not have to interact with your fellow countrymen, and much of the interactions adults do in practice is often in the economic sphare, but if you do not need anything from the people around you because your “country” is the universal state, you will become indifferent to the interests of the society you live in. We can see that with a lot of digital nomads, but I digress.

Finally for my final example, experts are essentially abstract intelectuals. In the past, intelectuals existed in the context of their society (think about Socrates who talked to people in Athens, he needed to interact with his society), and needed to win the trust of their contemporeries, mainly through good character, which you show by taking part of public life (Socrates was an officer in the phelepobesian war, Franklin was an active public servent), and by being able to offer actual value people want (I once read an anecdote where someone had an illness, and John Lock was called to try and perform surgery simply because he was the smartest man around and nobody else knew what to do). Today, experts are people nobody have heard about (Fauchi seemed to come out of no where, didn’t he?), and few actually want or need their help. But “trust the science” is like fiat credit, it replaced notions of good character or personal recognition, and bureaucracy replaced value.

Bakbook – good points. I think abstraction also comes with scale. It was understood by the theorists of modern democracy that a direct democratic system could not work beyond the size of a Greek city state. To have democracy at scale meant you had to vote for a representative who would supposedly uphold your interests. That might have worked if interests were based on geography but already in the 19th century interests were more based on class or other abstractions. That’s the basis of the modern party system but then parties themselves become an abstract grouping of various already abstract interests.

In reality, democracy is still based on horse trading. You give me something that I want and I give you something that you want. But now even those issues are abstractions. You give me money to “secure the border” (whatever that means) and I’ll give you money to send to Ukraine (“why are we in Ukraine again?”). In the US now, just to get a bill voted on requires so many different factions to be appeased that you get these Frankenstein bills that don’t make any sense and the bills are so big that nobody could ever read them, debate them and vote on them in any kind of rational fashion. This was the point that the historian, Vico, made. Abstractions lead to barbarism.

My post on Toynbee. https://senecaeffect.substack.com/p/exporting-the-husk-without-the-grain

Thanks, Ugo

Simon,

I think you are right. I believe it was Thomas Jefferson who said it is only possible for groups of up to 150 people to work together interpersonally, and it fits my experiance very well.

Spoke too soon, I think this is what I was thinking about: https://en.m.wikipedia.org/wiki/Dunbar%27s_number

Bakbook – I’ve always liked this diagram to capture a similar idea:

I’m quite convinced that 4 is the maximum number of people we can communicate with “freely” in real time. Music is a great example. A jazz trio or quartet can improvise together in real time but a quintet is already too much and requires more formal methods of organisation.